Why Should Delaware Care?

Residents, particularly in New Castle County, are still reeling from Delaware’s first statewide property reassessment in 40 years. With an ongoing lawsuit and upcoming legislative committee hearings in Dover still looming, Spotlight Delaware created a timeline of key moments throughout the decades-long journey to the recent reassessment.

Delaware’s first-in-40-year property reassessment saga, which sparked outcry from New Castle County residents earlier this year at the sticker shock of their new tax bills, has devolved into lawsuits from landlords, legislative hearings about how best to provide relief, and lawmakers sparring over who is to blame.

But how exactly did we get here?

To explore some of the key moments along the way, Spotlight Delaware created the following timeline, dating back to Sussex County’s last property assessment in 1974.

The timeline

1974: Sussex County assesses its property values – its last until 2024.

1983: New Castle County assesses property values – its last until 2024.

1987: Kent County assesses property values – its last until 2023.

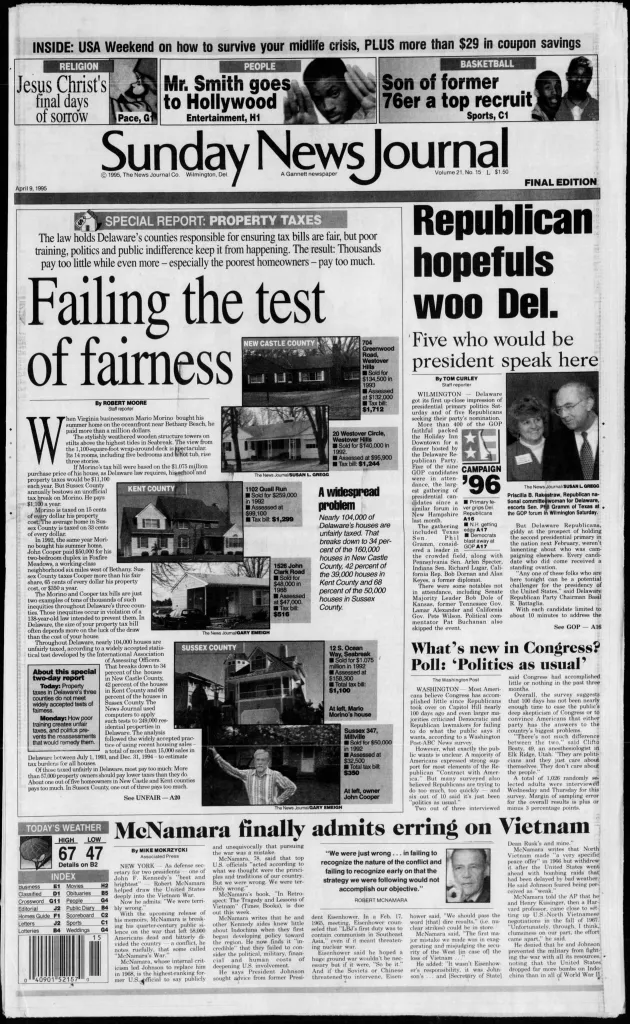

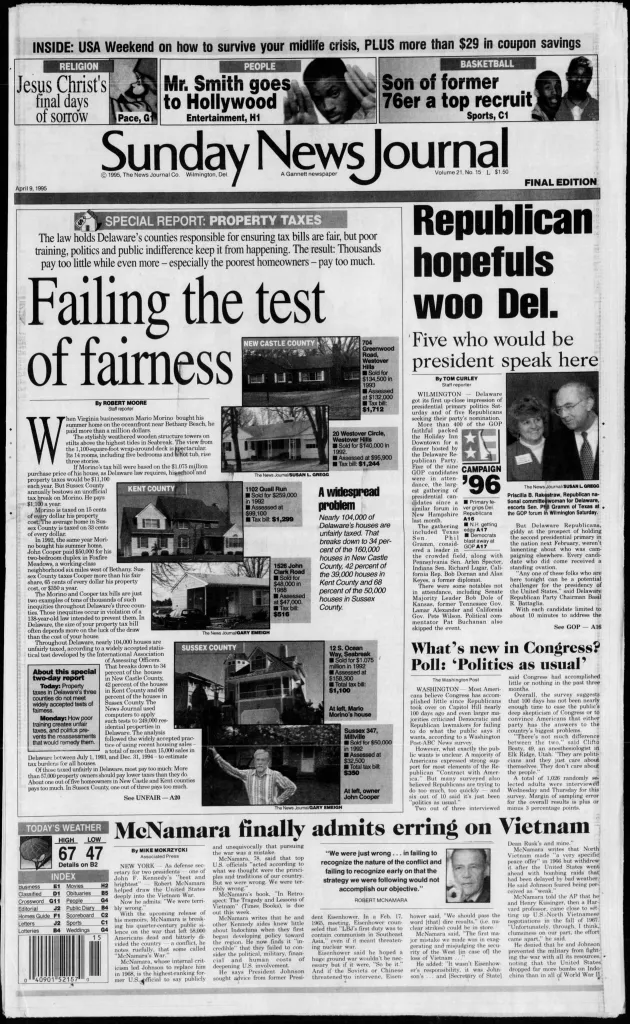

April 9, 1995: The News Journal publishes a special report on the unfairness of Delaware’s property tax system, more than 20 years since the last property tax assessment in Sussex County, 12 years since New Castle’s and eight years since Kent’s.

“The law holds Delaware counties responsible for ensuring tax bills are fair, but poor training, politics and public indifference keep it from happening,” the report reads. “The result: Thousands pay too little while even more – especially the poorest homeowners – pay too much.”

According to the report, elected officials in Delaware delayed ordering reassessments because they were politically unpopular. When those assessments were ordered, they often were conducted by overworked and undertrained staff members, which resulted in errors.

January 2018: Civil rights groups – including Delawareans for Educational Opportunity, the ACLU of Delaware and the NAACP of Delaware – sued the state over its alleged education funding inequities. The groups claimed the state was failing students from low-income families, students with disabilities and students learning English as a second language.

One part of the funding problem, the lawsuit alleged, was the lack of property reassessments in nearly 30 years. Using outdated assessments, which are used to calculate annual school property tax bills, had caused the tax base to remain stagnant while costs to run a school had soared.

August 2018: Chancery Court Vice Chancellor J. Thomas Laster split the education funding lawsuit into two separate cases, creating one specifically to consider the constitutional question of property tax assessments.

March 2019: The city of Wilmington joined the ACLU’s lawsuit challenging Delaware’s decades old property assessments, expanding the slate of arguments beyond its impacts on education.

According to The News Journal, Wilmington’s assistant city solicitor argued at the time that New Castle County’s outdated tax values created an unfair system and instability in the funding of city government.

August 2019: A report published in The News Journal outlines why, despite agreeing there should be a property tax reassessment “to bring fairness back to the system,” Delaware’s politicians have largely failed to act.

Echoing reporting from 1995, the article explains that reassessments are not politically popular, with residents viewing them as an across-the-board tax increase. This makes politicians hesitant to touch the issue, especially if their constituents are not encouraging action.

Property assessments also are costly undertakings, with Gov. Meyer – then New Castle County Executive – saying in the article he received estimates between $15 million and $27 million.

New Castle County ultimately paid more than $14.3 million for its 2024 reassessment.

May 2020: Judge Laster ruled that Delaware’s property tax system is unconstitutional, charting Delaware’s course toward its first statewide property reassessment more than 40 decades.

Laster wrote that the outdated property values each of Delaware’s three counties used to calculate annual tax bills violated a provision in the state constitution requiring property owners be taxed equally.

June 2021: New Castle, Kent and Sussex each respectively sign contracts with Tyler Technologies, a Texas-based software and technology service provider, to conduct their property reassessments.

Tyler, one of the largest mass appraisal firms in the country, was one of only a few companies to respond to the counties’ individual requests for proposals to complete the reassessment project.

Tyler was contracted to complete its Kent County reassessment in 2023, with New Castle and Sussex scheduled to be completed the following year.

August 2023: Then Gov. John Carney signed House Bill 62 into law, mandating counties perform property reassessments at least every 5 years.

Fall/Winter 2023: Kent County, the first to complete its reassessment, sent out tentative value notices to residents in “late 2023,” County Administrator Kevin Sipple said during a legislative committee hearing called in October 2025 to investigate the impacts of the state’s reassessment.

Those notices began the informal process in which Kent County residents could appeal the appraised property values they received from Tyler Technologies.

November 2024: One year later, those same tentative value notices were sent to New Castle and Sussex County property owners, giving residents their first insight into how their tax bills might change.

July 2025: Post-assessment property tax bills were sent out in New Castle County, prompting outrage from many residents over the sticker shock of the increases in their bill. For some residents, tax bills doubled after the reassessment.

In New Castle County, the assessment also shifted more weight onto residential taxpayers. County data indicates that before the reassessment, residential properties made up about 66% of the county’s tax burden. Afterward, they represented 76%.

Aug. 12 2025: In response to resident outrage, state lawmakers held a one-day special legislative session in Dover, passing 6 bills and 1 resolution aimed at property tax relief.

Most notably of those, House Bill 242 allows school districts in New Castle County to charge higher property tax rates on commercially owned land in order to subsequently lower the rates on residential properties.

Sept. 12, 2025: A coalition of landlords and hotel owners sued the state, New Castle County and its six school districts seeking to overturn the split-rate tax structures that legislators approved with HB 242.

The lawsuit also sought to pause the enforcement of the law, arguing that a failure to do so before the Nov. 30 tax payment deadline could cause “irreparable harm” to their businesses.

New Castle County was already preparing new tax bills based on the split rates, meant to supplant bills that were mailed out in July, when the lawsuit was filed.

Sept. 23, 2025: A judge in Delaware’s Court of Chancery, where the landlords’ lawsuit was filed, did not pause HB 242’s enforcement. Instead, Vice Chancellor Lori Will committed to fast-tracking a resolution to the entire lawsuit by the end of October.

A final hearing in the case is scheduled for Oct. 20.

Because of the lawsuit, New Castle County has not yet sent out amended tax bills, which are due to be returned by Nov. 30.

Sept. 30, 2025: During a legislative committee hearing in Dover, New Castle County Executive Marcus Henry told state legislators Tuesday that his predecessor – Gov. Matt Meyer – delayed the release of property reassessment data until after the 2024 election.

Henry said that the county’s assessment contractor, Tyler Technologies, was prepared to release tentative valuation notices to the public in the summer of 2024 – right in the middle of a heated gubernatorial primary between Meyer and former Lt. Gov. Bethany Hall-Long.

“It is also our understanding that the former Administration said no to those recommendations,” Henry said. “Instead, the assessment office was advised that tentative value notices couldn’t go out until mid-November. Accordingly, in mid-November 2024, Tyler mailed those notices of tentative value to property owners, the school districts, and to the municipalities.”

Oct. 3, 2025: Three days later, the governor’s office denied that claim, providing Spotlight Delaware with documents pulled from Meyer’s final years as New Castle County’s executive that it says shows the decision to push back the release of data came much earlier.

Meyer’s office pointed to Tyler Technologies’ contract, which was signed in June 2021 by the New Castle County Council. The contract lays out two different potential timelines — the second of which roughly makes the timeline that ultimately occurred, with tentative valuation notices being sent in mid-November 2024.

Oct. 9, 2025: Last week, lawyers for the landlords and hotel owners added a new wrinkle to the already fraught assessment saga by seeking to amend their lawsuit.

The new request could put New Castle County’s goal of mailing out and subsequently collecting its long-delayed property tax bills by the end of November at risk.

What’s next?

With questions about the legality of New Castle County’s split tax rate still looming, the state’s first-in-40-year property tax reassessment saga – at least for northern Delawareans – is far from over.

State lawmakers are scheduled to hold at least two more committee hearings next month to determine what remedies, if any, are needed at the state level to help prevent this year’s assessment drama from repeating itself.

As state leaders mull those questions, at least one county is already in the early stages of planning for its next five year assessment.

Sussex County Finance Director Gina Jennings told lawmakers that in a preliminary conversation with Tyler Technologies, she was quoted around $15 million to conduct the county’s next reassessment – about 50% more than what it cost this time.

Karl Baker and Jacob Owens contributed to this report.